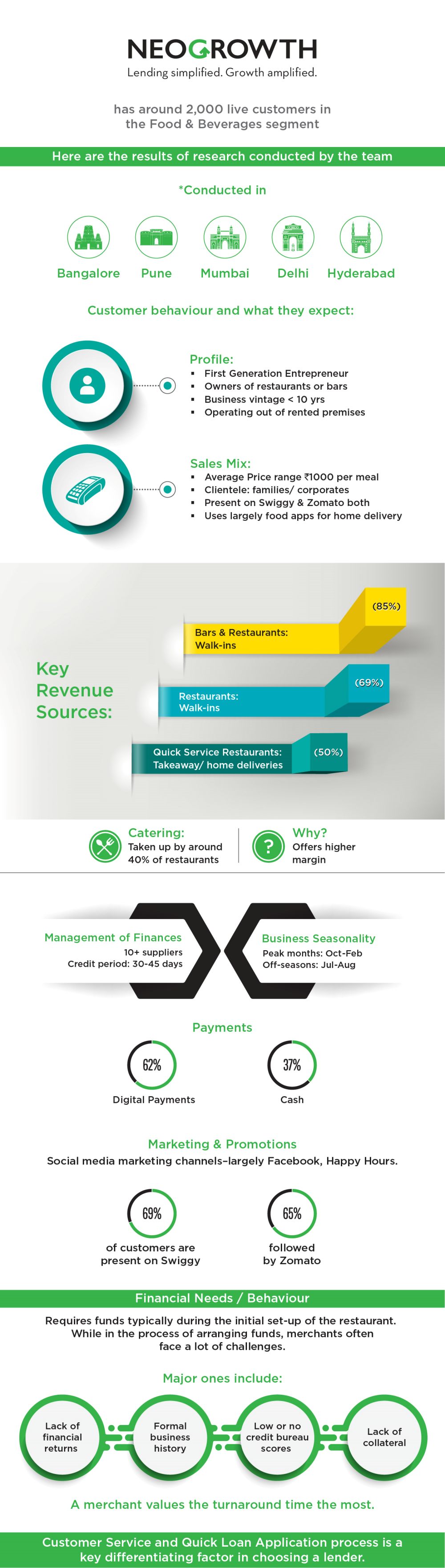

The Food & Beverages industry in India is constantly changing and evolving with new trends emerging and impacting the segment in significant ways. With over 2,000 of its live customers belonging to the F&B space, NeoGrowth, India’s leading fintech NBFC serving underbanked SMEs, recently researched its customer base to gain an insight into the behaviour and operational dynamics of players in this segment.

The study conducted in five metro cities namely Bangalore, Pune, Mumbai, Delhi and Hyderabad maps the critical trends in the consumer behaviour, business model, payment pattern and financial needs of NeoGrowth customers in F&B segment.

One of the key trends is the emergence of an increasing number of first-generation entrepreneurs starting a food venture. In a market that has been primarily dominated by players having a lineage of food business, entrepreneurs with no prior relevant business experience are interestingly venturing into this segment. These entrepreneurs mostly own restaurants or bars, operating out of rented premises. Otherwise, typically the average profile of a player in this segment is an established entrepreneur with the business vintage of fewer than ten years.

While NeoGrowth tried to understand the sources of revenue, an interesting trend was observed which did not exist a decade ago. Even though walk-ins generate 85% of revenue for restaurants and bars and~69% for restaurants, an increasingly significant chunk of income is coming through food aggregators like Swiggy and Zomato.

NeoGrowth, being a digital lender, leverages on not just card payments over point-of-sale machines but also considers online sales from these food aggregators as well while calculating the available loan amount. Around 69% of F&B customers of NeoGrowth are present on Swiggy app, closely followed by Zomato at 65%.

Apart from walk-ins and delivery, catering is another vital source of revenue for around 40% of NeoGrowth customers surveyed. It was observed that typically established restaurants are leveraging catering since catering orders result in higher margins, lower operating cost and usher in top brand visibility potential.

A significant trend observed amongst this segment is that the MSME businesses are becoming more customer-centric and increasing their presence online to promote marketing offers, discounts, events. For instance, one of the NeoGrowth customers in Pune feels Instagram is a useful marketing tool for promoting their restaurant page, merchandise, events and marketing offers/discounts.

Social media marketing and promotional activity through Facebook are being leveraged by most of the NeoGrowth customers, which implies that businesses are starting to embrace the digital way of growing their customer base as well.

NeoGrowth also lends to the Quick Service Restaurants (QSRs), which is a fast-growing segment of the F&B industry. The trend of QSRs is found to be rapidly gaining traction with increased urbanization, evolving consumer lifestyles and behaviour.

Because of factors like minimal dine-in space and ready availability at odd hours of the day, as much as 50% of the revenue generated by these QSRs is through takeaways and home deliveries. This is in contrary to the trend observed for dining restaurants and bars.

The QSR business model is more delivery focused and relies heavily on food aggregator apps besides catering orders. In fact, because of the relatively smaller size of transactions per unit, there is a high penetration of usage of new-age digital payments modes, namely mWallets and Unified Payments Interface (UPI).

According to the report, there has been a clear trend of increasing adoption of digital modes of payment amongst customers of these F&B businesses. The research report points out that the penetration of digital payments, including mWallets and UPI, is about 62%whereas cash-based payments hovers around37%. Interestingly, in Bengaluru and Hyderabad, the usage of digital payment modes is 25% higher than the industry average observed.

Commenting on the curation of this research, Piyush Khaitan, Founder and Managing Director, NeoGrowth remarked, “At NeoGrowth, we have always focused on building a deep understanding of the segments that our customers belong to, to address their specific credit challenges.

The Food & Beverages segment forms a significant part of our clientele, with over 2000 of our live customers belonging to this segment. Therefore, through this research, we wanted to draw key insights and map the various trends impacting this segment. This research study has drawn interesting insights and enabled NeoGrowth to deep dive into the Food & Beverages industry and build more customized and segment-specific loan product.”

The research also mapped the financial behaviour of NeoGrowth customers. Traditionally, MSMEs have been facing a lot of challenges while availing a loan for their business due to lack of collateral, improper documentation especially Income Tax returns and the lack of or insufficient credit history of being able to borrow from banks and established NBFCs.

The customer research pointed out that even though lenders approve credit, but often it comes after a lot of delays, and this inhibits growth. More than one-third of customers remarked that the timely availability of funds is crucial for their working capital needs. Also, it was observed that the customers are not highly sensitive to interest rate due to difficulties faced in getting a loan. This is where NeoGrowth comes in the picture.

Through its innovative tech-enabled and smart analytics-led approach, NeoGrowth assesses both traditional as well as non-traditional data points to power its underwriting mechanisms. This enables it to accurately validate the creditworthiness of a business, consequently offering the best-suited loan product for their specific needs.

This research also signifies how the platform has been extensively working towards serving its customers in a more effective and sector-centric manner by gaining a deeper understanding of the same. By facilitating timely financial aid to numerous small and medium business merchants belonging to different industries and verticals, NeoGrowth is actively working towards its mission of creating a positive social impact while simultaneously contributing to the inclusive growth of India.